Top Guidelines Of What Health Insurance Companies Are In Florida

Table of Contents4 Simple Techniques For Health Insurance Tampa FlThe Main Principles Of What Health Insurance Companies Are In Florida 6 Easy Facts About Medicare Advantage Plans Tampa ShownGetting My Health Insurance Tampa Fl To WorkIndicators on Health Insurance Tampa Fl You Should Know

If you require medications, are they available as well as cost effective under a selected strategy? A reduced out-of-pocket maximum might be better, so you have protection for unexpected injuries or diseases.Hearing loss prevails as we age. In this source guide, we outline the hearing services, gadget ...

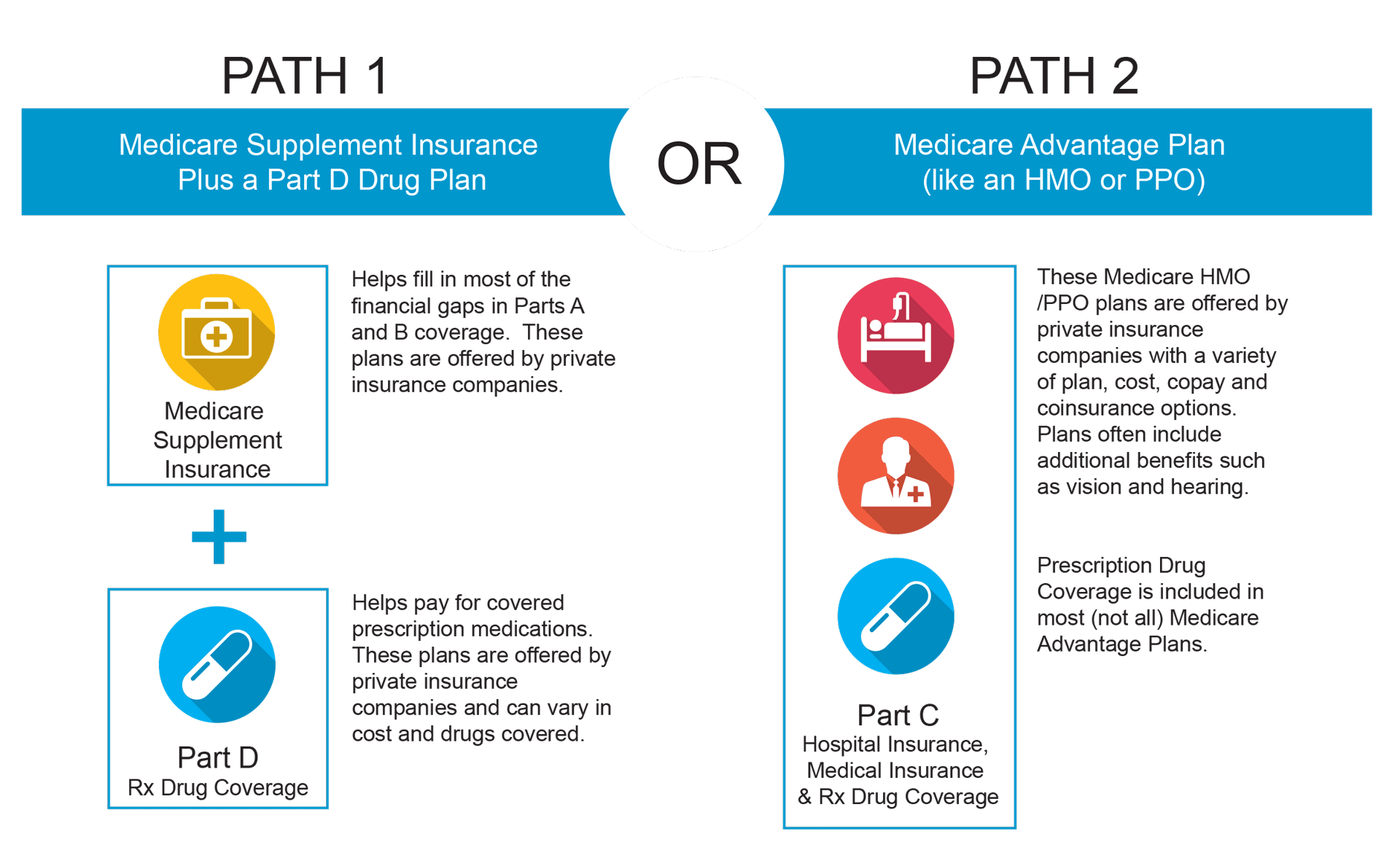

These plans are used by insurance policy companies, not the government government., you must likewise qualify for Medicare Parts An as well as B. You can take a look at the chart over for a refresher on qualification. Medicare Advantage strategies likewise have certain solution areas they can offer coverage in. These service areas are licensed by the state and also approved by Medicare.

The Best Guide To What Health Insurance Companies Are In Florida

The majority of insurance plans have a website where you can examine if your medical professionals are in-network. Maintain this number in mind while evaluating your various plan alternatives.

This varies per plan. You can see any service provider throughout the united state that approves Medicare. You have a specific selection of suppliers to pick from. You will pay even more for out-of-network services. You can still get eye take care of medical conditions, however Original Medicare does not cover eye tests for glasses or get in touches with.

Lots of Medicare Advantage prepares deal fringe benefits for oral care. Numerous Medicare Benefit prepares deal added advantages for hearing-related solutions. You can buy a separate Component D Medicare medication plan. It is uncommon for a Medicare Benefit strategy to not include drug coverage - tampa fl health insurance. You can have twin insurance coverage with Initial Medicare and also various other coverage, such as TRICARE, Medigap, expert's benefits, company plans, Medicaid, etc.

However you can have various other dual coverage with Medicaid or Special Requirements Strategies (SNPs).

Unknown Facts About What Health Insurance Companies Are In Florida

Medicare Benefit Plans need to cover mostly all of the medically needed services that Original Medicare covers. Nonetheless, if you remain in a Medicare Advantage Plan, Original Medicare will certainly still cover the price for hospice treatment, some brand-new Medicare advantages, and some costs for scientific study studies - health insurance tampa. The Majority Of Medicare Benefit Plans deal protection for things that aren't covered by Initial Medicare, like vision, hearing, dental, and also wellness programs (like gym memberships).

Medicare is a Wellness Insurance Policy Program for: Individuals 65 years of age and also older. Medicare has 4 components: Part A (Healthcare Facility Insurance).

In read the article many Medicare took care of treatment plans, you can just go to medical professionals, experts, or healthcare facilities that are part of the plan. Medicare took care of care strategies give all the benefits that Original Medicare covers.

The click here to read FEHB health plan brochures describe how they work with advantages with Medicare, depending on the sort of Medicare took care of treatment strategy you have. If you are eligible for Medicare coverage reviewed this details meticulously, as it will certainly have a real bearing on your advantages. The Initial Medicare Strategy (Original Medicare) is available almost everywhere in the United States.

Some Known Factual Statements About Medicare Advantage Plans Tampa

You may go to any kind of physician, professional, or hospital that accepts Medicare. The Initial Medicare Plan pays its share and also you pay your share.

Just call the Social Security Management toll-fee number 1-800-772-1213 to establish a consultation to use. If you do not request one or more Parts of Medicare, you can still be covered under the FEHB Program. If you can get premium-free Component A coverage, we encourage you to register in it.

It is the way everyone made use of to obtain Medicare benefits and is the means most individuals get their Medicare Part An and also Component B benefits currently. You might go to any kind of doctor, specialist, or medical facility that accepts Medicare. The Initial Medicare Plan pays its share and you pay your share.

Please consult your wellness plan for specific details regarding filing your cases when you have the Original Medicare Strategy. If you are qualified for Medicare, you may pick to enlist in and obtain your Medicare benefits from a Medicare Benefit plan. These are exclusive health and wellness care options (like HMO's) in some areas of the country.

8 Simple Techniques For What Health Insurance Companies Are In Florida

When the FEHB strategy is the key payer, the FEHB strategy will certainly process the claim. If you sign up in Medicare Part D and also we are the secondary payer, we will evaluate insurance claims for your prescription medication expenses that are not covered by Medicare Component D and also consider them for settlement under the FEHB strategy.

What added solutions are used (i. e. precautionary treatment, vision, dental, health and wellness club membership) Any type of treatments you need that aren't covered by the plan If you wish to enroll in a Medicare Benefit plan, you should: Be eligible for Medicare Be signed up in both Medicare Part An as well as Medicare Part B (you can examine this by describing your red, white, and also blue Medicare card) Live within the plan's service area (which is based on the county you live innot your state of residence) Not have end-stage kidney illness (ESRD).